Investment Implications and Risk Management Strategies for Investors

380 likes | 479 Views

Explore the drifts in central tendency measures and their implications for investors based on age and risk tolerance. Learn about life expectancy, risk management, and the role of asset managers in optimizing portfolios. Understand the trade-off between expected returns and risks in investment decisions.

Investment Implications and Risk Management Strategies for Investors

E N D

Presentation Transcript

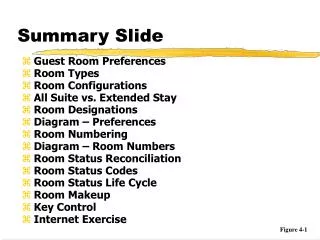

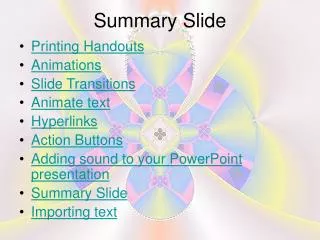

Slide Sequence Summary • The next table summarizes the drifts of the measures of central tendency • Note that the means do in fact tie back to the trajectories • The last (anomalous?) trajectory not an uncommon occurrence, and I was pfah with you

Implication for Investors • If you are older, the average remaining life of the investment is relatively short, and there is a larger probability that an investment in the risky security will result in a loss • This is not serious if you have substantial assets, in which case you can afford to take the risk, and enjoy higher expected returns

Implication for Investors • If you are younger, the average remaining life of retirement investment is longer, and there is only a small probability that an investment in the risky security will be less than the “safer” one • Investing in the less risky security will almost always result in a significantly smaller retirement income

Implication for Investors • Relatively early during a typical life cycle, there may be a need to liquidate some invested funds, perhaps for a house deposit, a child’s education, or an uninsured medical emergency • In the case where liquidating an investment early may damage long-term goals, some precautionary funds should be kept in lower-risk securities

Time Horizons • Planning horizon • The total length of time for which one plans • Decision horizon • The length of time between decisions to revise a portfolio • Trading horizon • The shortest possible time interval over which investors may revise their portfolios

Computing Life Expectancy • Mortality tables may be organized as three columns: actuary age, deaths/year per 1000 live births, and remaining life expectation. Note: • if you survive from 60 to 65, for example, the expected date of your death advances by 3 to 4 years • young women have a higher life expectation than men, but this is lost with advancing age

Useful Internet Address • The Society of Actuaries maintain a web site that provides detailed mortality tables, interactive computer models, mortgage experiences, career information, and current research papers • www.soa.org

Life Expectancy • 25 • 20 • MExLife • 15 • FExLife • Remaining Expected Life • 10 • 5 • 0 • 60 • 65 • 70 • 75 • 80 • 85 • 90 • 95 • Age

Risk Tolerance • Your tolerance for bearing risk is a major determinant of portfolio choices • It is the mirror image of risk aversion • Whatever its cause, we do not distinguish between capacity to bear risk and attitude towards risk

Role of Professional Asset Managers • Most people have neither the time nor the skill necessary to optimize a portfolio for risk and return • Professional fund managers provide this service as • individually designed solutions to the precise needs of a customer ($$$$) • a set of financial products which may be used together to satisfy most customer goals ($$)

12. 2 Trade-Off between Expected Return and Risk • Assume a world with a single risky asset and a single riskless asset • The risky asset is, in the real world, a portfolio of risky assets • The risk-free asset is a default-free bond with the same maturity as the investor’s decision (or possibly the trading) horizon

Trade-Off between Expected Return and Risk • The assumption of a risky and riskless security simplifies the analysis

Combining the Riskless Asset and a Single Risky Asset • Assume that you invest W1 proportion of your wealth in security 1 and proportion W2 of your wealth in security 2 • You must invest in either 1 or 2, so W1+W2 = 1 • Let 2 be the riskless asset, and 1 be the risky asset (portfolio)

Combining the Riskless Asset and a Single Risky Asset • Your statistics background tells you how to determine the expected return and volatility of any two-security portfolio • 1. Form a new random variable, the return of the portfolio,RP, from the two given random variables, R1 and R2 • RP = W1*R1 + W2*R2

Combining the Riskless Asset and a Single Risky Asset • The expected return of the portfolio is the weighted average of the component returns • mp = W1*m1 + W2*m2 • mp = W1*m1 + (1- W1)*m2

Combining the Riskless Asset and a Single Risky Asset • The volatility of the portfolio is not quite as simple: • sp = ((W1* s1)2 + 2W1* s1* W2* s2 + (W2* s2)2)1/2

Combining the Riskless Asset and a Single Risky Asset • We know something special about the portfolio, namely that security 2 is riskless, so s2 = 0, and sp becomes: • sp = ((W1* s1)2 + 2W1* s1* W2* 0 + (W2* 0)2)1/2 • sp = |W1| * s1

Combining the Riskless Asset and a Single Risky Asset • In summary • sp = |W1| * s1, And: • mp = W1*m1 + (1- W1)*rf , So: • If W1>0, mp = [(rf -m1)/ s1]*sp + rf • Else mp = [(m1-rf )/ s1]*sp + rf

Reflection • The risk-free rate, rf, the risky security’s expected rate of return, m1, and volatility, s1, are constants, so we have a “ray” that “reflects” from the expected return axes at mp = rf

Illustration • Consider the set of all portfolios that may be formed by investing (long and or short) in • a risky security with a volatility of 20% and an expected return of 15% • a riskless security with a volatility of 0% and a known return of 5%

Sub-Optimal Investments • Investments on the higher part of the line are always preferred (by normal folk) to investments on the lower part of the line, so for our current purposes we may ignore the lower line • That is, we will not sell the risky asset short and invest the proceeds in the riskless security

Long risky and short risk-free • 100% Risky • Long both risky and risk-free • 100% Risk-less

Observations • An investor with a low risk tolerance may invest in a portfolio containing a small % of risky securities, and a correspondingly higher % of riskless securities • An investor with a high tolerance for risk may sell risk-free securities he does not own, and invest the proceeding in the risky investment • They both use the same two securities

Observations • The graph has been labeled the “capital market line” a little prematurely • We will soon discover that if • the risky security is the market portfolio of risky securities • investors have similar expectations and time horizons • All investors will invest (long or short) in the market portfolio and risk-free security • The line joins the capital markets for risky and risk-less securities

Achieving a Target Expected Return (1) • Your boss has just read an ad’ that included the data for the Janus Twenty Fund (Scientific American, Sept 1998, page 6) • “You beat them, or I’ll find another portfolio manager”, she quips • “Wrong way to compute return?” you venture, as you rush for the door

To obtain a 20% Return • You settle on a 20% return, and decide not to pursue on the computational issue • Recall: mp = W1*m1 + (1- W1)*rf • Your portfolio: s = 20%, m = 15%, rf = 5% • So: W1 = (mp - rf)/(m1 - rf) • = (0.20 - 0.05)/(0.15 - 0.05) = 150%

To obtain a 20% Return • Assume that you manage a $50,000,000 portfolio • A W1 of 1.5 or 150% means you invest (go long) $75,000,000, and borrow (short) $25,000,000 to finance the difference • Borrowing at the risk-free rate is moot

To obtain a 20% Return • How risky is this strategy? sp = |W1| * s1 = 1.5 * 0.20 = 0.30 • The portfolio has a volatility of 30%

Important Observation • It doesn’t require much skill to leverage a portfolio; stockbrokers will let most investors trade “on margin” • When evaluating an investment’s performance, you must examine both the risk and the expected return

Returning to the Example • Advertisements for mutual funds do not generally disclose a quantifiable measure of risk, and Janus is no exception • The advertised “Janus Twenty Fund” returns are completely meaningless from a financial point of view • More information is needed

Returning to the Example • You can leverage the funds expected returns up or down • If you want an expected returns of 10%, or, 20%, 30%, 40%, 50%, 60%… you can have it (under the condition you can continue to borrow at the risk-free rate)

How Should my Boss Judge my Fund’s Performance? • It is a little early to answer this question • If the risky security is the market portfolio, then given your portfolio’s risk, consistent returns above the CML line may appear appealing

Portfolio Efficiency • An efficient portfolio is defined as the portfolio that offers the investor the highest possible expected rate of return at a specific risk • We now investigate more than one risky asset in a portfolio