From ‘Fear of Floating’ to Targeting Inflation: Comments on Arora (IMF) and Grandes, Peter and Pinaud (OECD)

170 likes | 356 Views

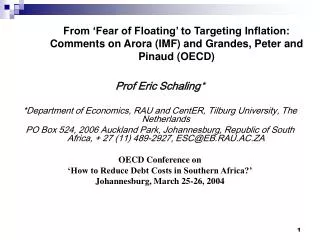

From ‘Fear of Floating’ to Targeting Inflation: Comments on Arora (IMF) and Grandes, Peter and Pinaud (OECD). Prof Eric Schaling * *Department of Economics, RAU and CentER, Tilburg University, The Netherlands

From ‘Fear of Floating’ to Targeting Inflation: Comments on Arora (IMF) and Grandes, Peter and Pinaud (OECD)

E N D

Presentation Transcript

From ‘Fear of Floating’ to Targeting Inflation: Comments on Arora (IMF) and Grandes, Peter and Pinaud (OECD) Prof Eric Schaling* *Department of Economics, RAU and CentER, Tilburg University, The Netherlands PO Box 524, 2006 Auckland Park, Johannesburg, Republic of South Africa, + 27 (11) 489-2927, ESC@EB.RAU.AC.ZA OECD Conference on ‘How to Reduce Debt Costs in Southern Africa?’ Johannesburg, March 25-26, 2004

INTRODUCTION • Comments on results of Arora (IMF): Both global and domestic factors matter for the SA sovereign spread. The forward book was a significant contributor to sovereign spreads • Schaling (RAU/CentER): Both global and domestic factors mattered. however, in the real world – unlike in the context of an econometric/statistical model – domestic and global factors cannot be separated. • In fact, over the relevant 1997:6-2003:9 sample in South Africa – especially in 1998 - some of the domestic factors such as the FORWB and the NOFP can be seen as the policy response to the global factors.

1. INTRODUCTION (CTD) • Supported by Grandes, Peter and Pinaud (OECD) who find that ‘The downsizing of the NOFP has contributed to dampening the perception of external vulnerability, i.e. to diminish the expectations of further depreciations of the rand’. • Conclusions: • A clean floating exchange rate should help further reduce spreads. • In the context of the present IT regime the SA monetary authorities should adopt a strictly hands-off approach to the exchange rate and should have NO FEAR OF FLOATING.

ARORA’S MAIN QUESTIONS • Two main questions: • Why do sovereign spreads matter? • Answer, is key determinant of domestic interest rates: • where is spread, and is an indicator of external vulnerability • What determines sovereign spreads; ?

ANSWER • Answer: , • the spread rises in response to higher risk from global, and domestic (country-specific) factors. • global factors: • risk appetite (ES for EM as a group), • industrial country interest rates, • liberalization of investment rules; • country-specificfactors: • public finances, • international reserves and obligations, • inflation expectations.

4. SOVEREIGN SPREADS IN SOUTH AFRICA • Global factors (EM as a group): proxied by EMBI spread for emerging markets (and its volatility), Prior: • Domestic (SA) factors: Domestic and foreign debt levels and maturities; forward book and NOFP and others. • Here the prior is that and

5. RESULTS (AHMED 2004) • Both global and domestic factors matter. The forward book was a significant contributor to sovereign spreads • In fact he finds that: • NB Domestic factors are more important than global factors!

6. COMMENT • Both global and domestic factors mattered. However, in the real world – unlike in the context of an econometric/statistical model – domestic and global factors cannot be separated. • Over the relevant 1997:6-2003:9 sample in South Africa – especially in 1998 - some of the domestic factors such as the FORWB and the NOFP can be seen as the policy response to the global factors.

6. COMMENT (CTD) • More specific, • Thus, the FORWB and the NOFP are not exogenous determinants of (sovereign spread), but are determined via the SA domestic monetary policy regime, which in SA between March 1995 and mid 1998, was de jure monetary targeting and de facto (various forms of) exchange rate targeting.

7. WHAT HAPPENED IN 1998? • Collapse of the Thai Baht on 2 July 1997 triggered the Asian crisis characterized by enormous volatility both of economies and financial markets, as globally international investors began to re-assess the risk premium that they had assigned to emerging markets (EM). • In 1998Q1 total net portfolio capital inflows peaked at R 22.9 bn, followed by an inflow of R12.8 bn in April alone. So, over the first four months of this year non-residents increased their holdings of SA equities and bonds by no less than R 34 billion. • As a consequence of the serious demand for South African securities the yield on the benchmark R 150 government bond bottomed at 12.4 percent in April 1998 (down from about 15.7 percent in January 1997).

7. WHAT HAPPENED IN 1998 (CTD)? • The trigger of events in 1998 was the re-assessment of risk associated with EM that affected the SA bond market in May 1998. • Then, the net-outflow (or stop of inflows) equaled R 3 bn or about 9.7 percent of the cumulated inflows at R 31 bn between 1997 and April 1998. May 1998 was a clear example of common exposure. • The SARB’s response to the outflows was a very aggressive FX market intervention • In May as a whole the NOFP increased by about US$ 5.1 bn from US$ 12.754 mn to US$ 17878 mn. Note that in the months of May to September 1998, the Reserve Bank increased the NOFP liability by US$ 10.45 bn to US$ 23.2 bn.

8 MAIN MESSAGE • Domestic factors (NOFP and FORWB) were conditioned on 1995:3-mid 1998 policy regime which was de facto exchange rate targeting. • The present regime of inflation targeting (IT) is likely to pay more respect to the so-called OPEN ECONOMY TRILEMMA and let the exchange rate float. • A clean floating exchange rate should help further reduce spreads.

8 MAIN MESSAGE (CTD) • Main message is supported by Grandes, Peter and Pinaud (2004) • where is the ‘currency premium’ • They find that or • ‘The downsizing of the NOFP has contributed to dampening the perception of external vulnerability, i.e. to diminish the expectations of further depreciations of the rand’

9. ASSESSMENT OF FX MARKET INTERVENTION • Reserve Bank forward market intervention policy to trade-off the level of FX reserves and the rate of appreciation of the rand was successful during the episode of substantial capital inflows between June 1995 and February 1996, when the SARB reduced the NOFP. • However, attempts by the Reserve Bank to trade-off the rate of currency depreciation against the level of its FX reserves failed during the episodes associated with substantial capital outflows between March 1996-February 1997 and May 1998-October 1998.

10. CONCLUSION In the context of the present IT regime the SA monetary authorities should adopt a strictly hands-off approach to the exchange rate and should have NO FEAR OF FLOATING.