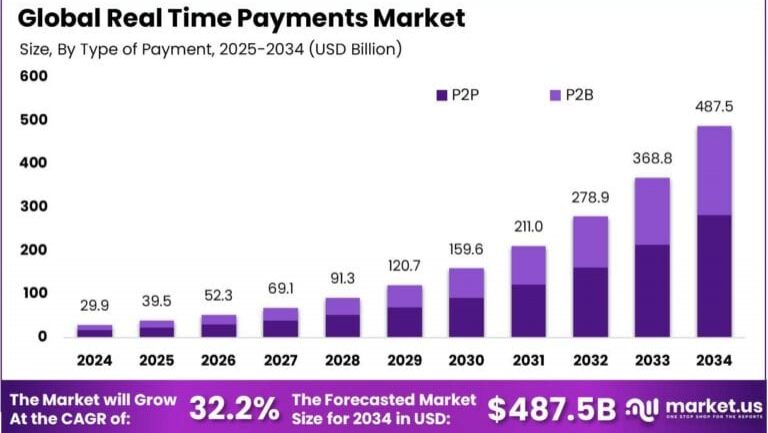

The Real-Time Payments (RTP) market refers to a financial ecosystem that enables instant or near-instant transfer of funds between banks and financial institutions. These transactions are processed in real time, twenty-four hours a day, seven days a week, with immediate confirmation to both sender and receiver. This market is growing rapidly across the globe as consumers, businesses, and governments increasingly expect faster, more transparent payment solutions. The surge in demand is supported by innovations in payment infrastructure, rising smartphone penetration, and a growing need for efficient cash flow management. RTP platforms are being adopted across industries such as retail, e-commerce, healthcare, and public services due to their speed, reliability, and improved user experience.

Top driving factors behind the expansion of the real-time payments market include the growing adoption of digital banking, customer demand for faster and safer transactions, and a shift toward contactless payments post-pandemic. Governments and regulatory bodies are also pushing for improved financial inclusion and greater payment efficiency, which further accelerates market development. Another major force is the demand from small and medium-sized enterprises, who benefit significantly from real-time fund availability and reduced dependency on credit lines.

Demand analysis shows a steady climb in RTP usage in both developed and emerging economies. In regions like Asia-Pacific and North America, transaction volumes are increasing at a remarkable pace, driven by a tech-savvy population and proactive regulatory policies. Consumers now expect faster settlements not only for peer-to-peer transfers but also for bill payments, salaries, and even loan disbursements. This growing demand is encouraging banks and fintech firms to invest heavily in RTP infrastructure.

The rising adoption of technologies such as cloud computing, open APIs, artificial intelligence, and machine learning is reshaping the RTP landscape. These technologies support real-time fraud detection, predictive analytics, and better customer personalization. They also make integration with legacy systems more feasible, allowing traditional banks to participate in the real-time revolution without overhauling their entire infrastructure.

The key reasons organizations are adopting real-time payments include improved liquidity, better customer retention, lower operational costs, and competitive advantage. Businesses can settle invoices instantly, reduce processing fees, and maintain more accurate cash flow forecasting. This results in smoother operations and stronger relationships with suppliers and customers alike.

Investment opportunities in the RTP market are broad and promising. Venture capital and private equity firms are increasingly funding startups that offer innovative RTP solutions. Established financial institutions are partnering with tech providers to launch real-time services. Payment infrastructure upgrades, mobile banking platforms, and cross-border real-time networks present particularly lucrative areas for strategic investment.

From a business benefits standpoint, real-time payments enhance transaction transparency, speed, and accuracy. They reduce the risk of fraud and errors while enabling better data tracking for compliance and reporting. Companies gain operational agility, and customers enjoy an improved payment experience—two critical aspects in today’s highly competitive financial landscape.

Technological advancements continue to transform the RTP space. The rise of decentralized finance (DeFi), blockchain integration, and tokenized payments is expanding the market's potential. Embedded finance, which enables real-time payments directly within apps or software, is another fast-emerging trend that promises to redefine how businesses manage payments and financial services.

The regulatory environment for real-time payments is also evolving. Governments are drafting frameworks that support interoperability, standardization, and data protection. Regulatory bodies are balancing innovation with security by enforcing guidelines that protect consumers while encouraging ecosystem expansion. Global initiatives such as ISO 20022 adoption are helping align national RTP systems, making cross-border transactions faster and more secure.

Top impacting factors in the RTP market include user expectations for instant gratification, the digital transformation of finance, economic shifts, technological readiness, and policy alignment. Each of these elements plays a critical role in shaping how fast and efficiently the RTP market grows. With so many influential forces converging, the real-time payments space is set to become a core pillar of the global financial infrastructure.

Real-Time Payments Market-Market:

The Real-Time Payments Market Market is a broad term that likely refers to a layered perspective or analysis of the RTP market from different market segmentation angles, such as regional trends, vertical-specific insights, and ecosystem-level investment. Though the phrasing appears repetitive, it highlights a more granular view of the market where every segment—whether it’s by technology, geography, or use case—is examined in detail to evaluate growth opportunities and performance metrics. This approach is common in industry reports that deep-dive into multiple layers of market dynamics.

In this more detailed outlook, top driving factors include infrastructure maturity, fintech innovation, and increasing collaboration between governments and private firms. Some regions, like Europe and Asia, are leading with established RTP frameworks and robust central bank support. In contrast, others are catching up, which represents major room for growth. Within verticals, sectors like retail, utilities, and logistics are pushing adoption forward as they require seamless, real-time settlements.

The demand for hyper-personalized, real-time services is also pushing banks and businesses to reconsider their legacy payment systems. More platforms are being redesigned to support multi-rail real-time capabilities, including domestic and international payment rails. In this segmented market view, demand is not only about volume but also about the sophistication of services and integration levels with existing business systems.

Increasing adoption of next-gen technologies like biometric authentication, real-time analytics, and digital ID systems is accelerating both consumer and business trust in RTP. This tech-driven trust forms the backbone of adoption, particularly in B2B and B2G payments where transparency and traceability are vital.

Key reasons for this deep-layered adoption include faster time-to-cash for businesses, improved settlement risk management, and the ability to offer enhanced financial products. For example, banks can now offer real-time loans, while retailers can enable just-in-time inventory restocking with instant supplier payments. These micro-benefits collectively drive macro-level adoption.