Economics

300 likes | 422 Views

Explore the essential concepts of investing in stocks and bonds, with insights on ownership, market indicators, and risk assessment. Learn about dividend yields, bond types, and the importance of a stockbroker. This guide breaks down key investment terms, analyzing debt and equity securities, highlighting the differences between corporate and government bonds, and explaining mutual funds. Whether you're considering your future financial goals or contemplating what to do with your savings, familiarize yourself with these foundational elements of investing.

Economics

E N D

Presentation Transcript

Economics Investing in Stocks and Bonds

October 24, 1929 Black Thursday

Stock Investment that shows ownership

NYSE Wall Street

Dividend Is Profit

DJIA Market indicator that averages 65 stocks in 3 different categories

Bull Market Prices are rising

Income – Expenses = List your expenses A look to your future! $$$ left over … For what?????

Fun Savings account Money market CD’s Government Bonds Treasury Bills Corporate Bonds Stocks Mutual Funds What are you going to do with the $ left over? Securities

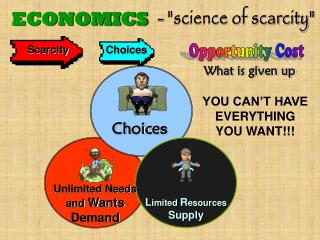

Securities refers to bonds, stocks and other documents that are sold by corporations and governments to raise large sums of $$$$. These investments are commonly divided into 2 major categories: 1 2 Debt Securities: when companies borrow $ Equity Securities: shows ownership

A bond is a certificate representing a promise to pay a definite amount of $ at a state interest rate on a specified maturity date. By buying a bond, you become a creditor of the organization and in return your $ is used to help build the company. What is a bond?

More about Bonds • Corporate bonds – bonds issued by a corp. • Government bonds - bonds issued by the government. • Face value – AKA maturity value – the amount is says on the face of the bond. • Bonds are sold in Bond Markets • Some risk (more in corporate bonds) • Bond prices are determined by buyers and sellers in the bond market.

Low Risk ... Low Return!! High Risk . . . High Return!!

Bonds cont. • Interest earned = purchase price – redemption (payoff value) • The time it takes for a bond to mature will be determined by the economy and current interest rates. • Purchase limit $30,000 (face value) • Pays interest when bond is cashed • Can be purchased at any financial institution. • HH pays interest semi-annually directly to the bondholder. • No purchase limit of HH bonds.

What does a stockbroker do? • Searching for potential clients using advertising, mailings lists, and personal contacts. • Interviewing clients to determine financial goals and resources. • Selling financial products and services to clients for investment purposes. • Completing computerized forms to process transactions requested by clients.

Investing in Stocks • You become part owner of a business • Stock certificate shows representations of stocks purchase. • Dividends = profit • High risk … High return. • Bond holders are paid first in goods times or bad times. • Stockholders may not get paid at all in bad times/bankruptcy.

Investing in Stocks cont. • Market value – price that is bought and sold on the market at one particular time – this is determined by how well the business is doing.

PS owners get paid dividends first. Less risk than common stock No voting rights in a corporation. CS owners are invited to shareholder meetings. Are paid dividends after preferred stock holders. CS holders have more potential to make money – higher risk … higher earnings. Preferred stock vs. Common stock

What do you look for in choosing a stock? • Company’s net worth • Amount of debt • Sales revenue (how much $ they bring in) • Profits • Dividend history • Current outlook for the company’s product and service. • SEC requires companies to file detailed reports electronically.

If you are considering investing in a company, you should ask the following questions … • Has the company been profitable over a period of years? • Have the company’s managers made good business decisions? • Does the company have growth potential in coming years? • Does the company have an unusually large amount of debt? • How does the company compare with others in its industry.

You should also consider … • The yield of a stock • Dividend = Dividend per share Market Price p/ share The higher the better

And … • Price Earnings Ratio • The ratio of a stock’s selling price to its earnings per share. • It gives you an indication of whether the stock is priced too high or low in relation to its earnings per/share. The lower ratio the better

Stockbroker – licensed specialist in the buying and selling of stocks and bonds for a free called a commission. • Full service broker – provides you with information about securities you may want to buy. • Discount broker – places orders only. Charges lower commission. • Brokers work through stock exchanges – business organizations that accommodate the buying an selling of securities. • NYSE – New York Stock Exchange • Mainly large companies ? • AMEX – American Stock Exchange • Medium size companies ? • NASDAQ – smaller companies?

Mutual Funds • Consist of buying and selling a variety of stocks and bonds in one family. • Less risk because where one stock goes down another may go up and it offsets the loss.

Online Investing • Becoming a standard practice for many individual investors • Get quotes for companies • Buy and sell stocks • Maintain a portfolio of your investments • Learning tips for new investors • Research company news, income statements, annual reports, and stock performance histories.

Do this at the end of the unit. • Set up a portfolio for the following people. • Starting out • Saving for college fund • Retirement age • Middle aged.