Difference between Short and Long Term Financing

0 likes | 18 Views

At Reliable Bookkeeping Services, Our aim is not limited to the compliance with Australian Taxation Office but also, understanding that clientu2019s requirement to have u201cup to dateu201d financial and analytical information, in order that this information will assist them in making the right decision. This will lead the business owners to gain back the valuable time so that they can focus on building the business. Up to date financial reporting includes our great services at a reasonable price.

Difference between Short and Long Term Financing

E N D

Presentation Transcript

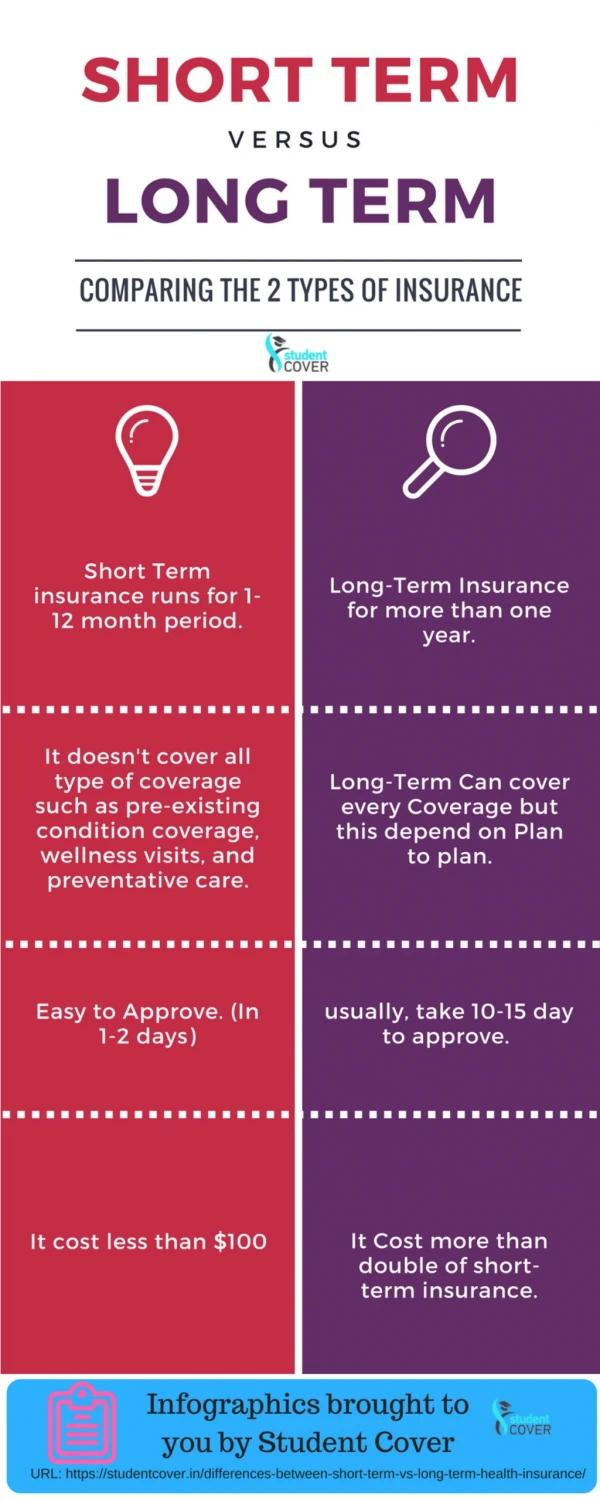

Difference between Short and Long Term Financing Short and Long Term Financing It could be a challenging task to maintain a healthy cash flow; between bills and ongoing expenses, staff and bottom line also the worse cash flow can influence your clients deeply.While developing a cash flow strategy, business owners must bear in mind the difference between ST and LT financing. As there are distinct sources of available finance and every source of finance is significant in different situations. Advantages of Short-Term and Long-Term Financing The advantages of long-term and short-term financing can be measured according to their adjustments with different requirements. When the businesses are initially acquiring the ground, they utilize short-term, asset-based financing. Short-Term Financing The short term funding is typically structured for the financial needs of the organization. Its lower abilities make it suited for fluctuations in the capital and other operating costs. In general, the banks and the borrowers give short-term lending with inflated interest rates.The businesses will not have to follow long application processes for electronic funding like inventory factoring. The basic requirement is the statement, payment history of the client, and the prospect outline of company. Enhances Capital The ST financing gives flexibility and resources to fund the needs regarding capital and it decreases the dependency on capital sources. It also aids companies to extend their abilities related to debt. Relates term of Asset with certain Responsibilities The abilities related to ST financing coordinates with the average assets purchased in a much efficient manner.

Long-Term Financing It co-exists with Long-Term Strategy Long-term financing allows an organization to align its capital formation with term-term goals. This assists the business to get profit as a return on investment. Relief on the basis of Long-Term The organizations can serve from having links with the same financers over a long time. Having good investors, the companies can seek long term connections along with ongoing assistance. As the investment is long term and the organization does not have to take in new financing allies frequently, who could not have a good idea of business. Also Read: Business Finance Guide: Short and Long Term Financing It limits the Company’s declaration to Interest Rate Risk Long-term financing decreases the risk of refinancing which appears with other types of debt, due to its fixed interest rate, thus reducing a company’s interest rate and balance risk.It is, however, crucial to observe both categories of financing to make sure about their working and their differences

If you need any type of assistance with your bookkeeping, or you want to run your business wisely, Contact now Reliable Bookkeeping Services – One of the Trusted Bookkeepers in Melbourneto turn your business dreams into reality.

Contact Us • For more information, you can contact us with the below details. Reliable Bookkeeping Services1/3 Westside AvenuePort Melbourne VIC 3207AustraliaContact:1300 049 534Mail: enquiry@reliablebookkeepingservices.com.au