Transfer Pricing under UAE Tax

20 likes | 127 Views

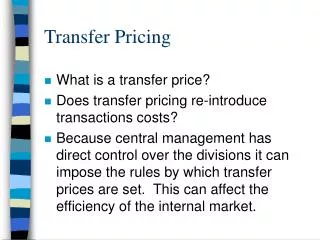

As of my knowledge cutoff in September 2021, the United Arab Emirates (UAE) did not have specific Transfer pricing regulations under UAE Tax . However, UAE-based multinational enterprises (MNEs) and permanent establishments of foreign entities need to be aware of the OECD's guidelines on transfer pricing, as these guidelines are followed by many countries where they may have business relationships.<br>Transfer pricing refers to the prices charged for commercial transactions between various parts of the same multinational group, such as sales of goods, provision of services, or lending of money. T

Download Presentation

Transfer Pricing under UAE Tax

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

More Related