International Business Insights for Indian Companies Expanding to USA

200 likes | 284 Views

Discover key considerations and strategies for Indian companies entering the USA market. Learn about legal, tax, and regulatory aspects, and essential business practices to succeed. Get expert advice from Dinsmore & Shohl LLP.

International Business Insights for Indian Companies Expanding to USA

E N D

Presentation Transcript

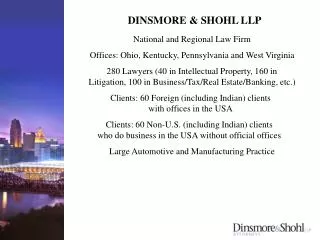

DINSMORE & SHOHL LLP National and Regional Law Firm Offices: Ohio, Kentucky, Pennsylvania and West Virginia 280 Lawyers (40 in Intellectual Property, 160 in Litigation, 100 in Business/Tax/Real Estate/Banking, etc.) Clients: 60 Foreign (including Indian) clients with offices in the USA Clients: 60 Non-U.S. (including Indian) clients who do business in the USA without official offices Large Automotive and Manufacturing Practice

Harvey Jay Cohen, Esq. harvey.cohen@dinslaw.com Telephone 1-513-977-8144 Facsimile 1-513-977-8423 At Dinsmore & Shohl for more than 19 years Georgetown University A.B. Cum Laude 1982 Columbia University, Masters International Affairs, Magna Cum Laude 1984 University of Cincinnati, Juris Doctor, Order of the Coif 1987 Please do not hesitate to ask questions during our presentation and afterward by e-mail or telephone

Close working Relationship with State Governments Corporate/Real Estate/ Tax Unions and Employment Intellectual Property and Franchising/Distribution/Sales Retirement Plans Immigration Litigation Automotive

Many services provided are faster, easier and cheaper in the USA ... Lawyers Accountants Banks Registrations with the Government; No Approvals Regulation of products is less stringent in many areas. This laxity varies greatly depending on the type of products and whether they are for sale to consumers or businesses Distribution of products, even across and into a vast market Taxes, unemployment insurance FUNDAMENTALS OF BUILDING YOUR BUSINESS:Principal Questions for Indian/Non U.S. companies doing business in the USA

Principal Questions for Indian/Non U.S. companies doing business in the USA (continued) Competition is less regulated Use of Distributors and Sales Agents as an entry strategy Termination of Distribution and Sales Agent contracts without fear of large damages. This can vary depending on the state Labor less organized into strong unions, less regulated Discharge/Termination of employees is less complex and costly Private ownership of real estate with no government regulation. Private buying and selling of companies (manufacturing or services), and private equity investment in companies, all with no government regulation. A proven entry strategy

Entry into the US, Initial Advice Always use a top-notch local lawyer, not just a Los Angeles or New York lawyer, etc. (2-3 times expense) A Delaware Corporation is not necessary For example, Procter & Gamble, large oil companies and other U.S. large companies are Ohio corporations. The vast majority of public corporations are not Delaware corporations Do not double your expenses and administrative burden

First steps Hire an Accountant/Tax advisor, register patents and trademarks and fulfill immigration formalities Create an Indian or offshore subsidiary to make U.S. sales or to own the U.S. entities, isolate the mother company from liability from the USA

State vs. Federal (Washington, D.C.) Law Uniform Commercial Code (state law on sales) Each state has its own Corporation/Business Code Each state is different in some ways, some important and some insignificant

Competition Competition/Anti-Trust rules are liberal/lax No agreement between competitors on price

Credit It is difficult to recover lent money or accounts receivable, as federal and state laws favor the debtor, especially in bankruptcy

Protect Yourself Retain Security Interests/Collateral in inventory, equipment, etc. Credit Insurance Use a well-drafted contract with tight payment terms You can demand interest up to typically 18%/year, depending on state law

Product Liability It is often said that this is a problem in the USA, and it is true Lawyers for victims are not paid by the hour, but take 33% of all awards Product liability insurance is essential Again, it is key to operate in an affiliated structure, reducing risk to the parent

Sales Laws The UN convention on the International Sales of Goods (CISG) applies in the USA. Pay attention. If a governing law clause in a contract designates a State (UCC) or Indian law, without specifically opting out of the CISG, the CISG will control and apply as the CISG automatically substitutes for state or Indian law. Pay attention to these clauses and opt out of the CISG if you wish.

Jurisdiction/Courts In contracts, it is possible: To be silent on venue Or to designate an Indian tribunal; but arbitration is best Or to choose a State/County court in the U.S. Or to choose mediation Or to choose arbitration Or to require business executives escalation between the parties before commencing litigation

Form of Contracts Insist that all contracts be complete and signed. Avoid verbal contracts or those on “scrap paper”/“cocktail napkins” In the USA you can choose the law to apply Conclusion: Freedom of contract is the rule in the U.S. You should use this freedom to your advantage

Contract Clauses You can limit damages to the value of the products or services sold You can limit warranties, e.g., the only warranty is performance to specifications for 90 days You can limit types of damages, e.g., eliminate consequential, indirect and punitive damages You can have an internal statute of limitations, e.g., after one year an aggrieved party cannot sue the other party It is possible to exclude all other guarantees/warranties, sometimes it is even possible to sell “as is” without a warranty

Distributors/Re-Sellers and Sales Representatives Use a carefully written-contract Keep the term short No automatic renewals Register all marks, URLs, patents, etc. Non-competition clauses are essential and may continue after expiration/termination Minimum sales levels to retain exclusivity Use a list of objective standards, which if breached, leads to termination You can terminate a Distributor or Sales Representative Agreement more simply than in other countries with less fear of damages. This result, depends on state law.

Entities Corporation Limited Liability Company (LLC) General Partnership (Partnership) Branch office of foreign entity (Branch)

Articles of a Company filed with State Government All forms of entity are granted/governed on receipt by states. No application process, approvals, financial statements, feasibility studies, etc. In Ohio, this happens on same day service. No extra form(s), reporting or approvals for foreign ownership US state laws in general are more liberal, less regulatory and less rigid, especially the LLC (you can almost do anything from a governance standpoint Little or no required capitalization. No approval of dividends. No requirement for an annual audit or filing of financial statements The identity of officers and directors is secret Financial results are secret

Conclusion In general, it is more simple, fast, easy, less regulated and cheaper to do business in the USA If you need assistance in the USA, please call us early in the process to use us to your maximum advantage. 1155686