THE BALANCE SHEET

220 likes | 643 Views

THE BALANCE SHEET. Claims against resources (Liabilities). Remaining claims accruing to owners (Owner’s Equity). BALANCE SHEET. Resources (Assets). BALANCE SHEET Fundamental Objectives.

THE BALANCE SHEET

E N D

Presentation Transcript

Claims against resources (Liabilities) Remaining claims accruing to owners (Owner’s Equity) BALANCE SHEET Resources (Assets)

BALANCE SHEETFundamental Objectives • Liquidity - length of time until assets are realized or converted to cash (or until a liability has to be paid) • Solvency– the ability of a firm to meet its debts as they come due • Financial flexibility - ability of company to manage its cash flows (deal with emergencies or take advantage of unexpected opportunities)

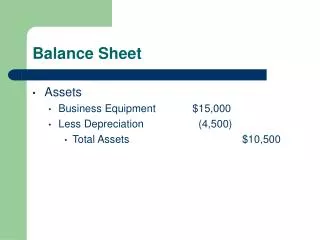

Balance Sheet Basic Definitions - SFAC No. 6 Assets Probable future economic benefits obtained or controlled by a particular entity as a result of past transactions or events.

Balance Sheet Basic Definitions - SFAC No. 6 Liabilities Probable future sacrifices of economic benefits arising from present obligations of a particular entity to transfer assets or provide services to other entities as a result of past transactions or events.

Balance Sheet Basic Definitions - SFAC No. 6 Owners’ Equity The residual interest in the assets of an entity that remains after its liabilities are deducted.

Cash Inventories Receivables Prepayments Balance Sheet Format Asset Classifications Current Assets

Investments and funds Intangibles Noncurrent Assets Property, Plant, & Equipment Deferred Charges Balance Sheet Format Asset Classifications

Current Liabilities Balance Sheet Format Liability Classifications Accounts Payable Short-term Notes Payable Collections in advance of unearned revenue Accrued Expenses

Capital Leases Long-term Notes Payable Noncurrent Liabilities Bonds Payable Pension Liabilities Balance Sheet Format Liability Classifications

Capital Stock Other Contributed Capital Retained Earnings Treasury Stock Balance Sheet Format Equity Classifications Owners’ Equity

WORKING CAPITAL ANALYSIS Current assets Less: Current liabilities Equals: Working Capital Current assets Current liabilities = Current Ratio (Working Capital Ratio)

Additional Reporting Issues • Loss and gain contingencies • Subsequent Events • Disclosure Notes • Valuations reported in the Balance Sheet • Comparative Statements

LOSS CONTINGENCIES • Disclose a loss contingency when . . . • Information available prior to issuance of the financial statements indicates that it is probable that an asset has been impaired or a liability has been incurred at the date of the statements, or • The amount of the loss can be reasonably estimated. • If both conditions exist, loss contingency must be accrued (recorded)

GAIN CONTINGENCIES • Gain contingencies are never recorded prior to realization “Conservatism” • They may be disclosed in footnotes discussed within the statements only if a high probability of realization exists

CONTINGENT LOSSES Likelihood Accounting Action Probable Recognize liability if amount can be estimated. If not disclose in a footnote Reasonably possible Disclose in a footnote Remote No recognition required, may disclose in a footnote CONTINGENT GAINS Likelihood Accounting Action Probable If amount can be estimated, conservative approach is to disclose in footnote. Reasonably possible May disclose in a footnote, but be careful to avoid misleading implications. Remote No recognition or disclosure ACCOUNTING FOR CONTINGENCIES

SUBSEQUENT EVENTS • Events occurring after the Balance Sheet date but before the issuance of the financial statements • They would have a material effect on the financial statements 3-8-x9 12-31-x8 Subsequent Period Balance Sheet Date Date Financials Issued

SUBSEQUENT EVENTS • Reported on the Balance Sheet (recorded) • If they provide additional evidence about conditions that existed at the balance sheet date • Reported in notes to the Balance Sheet • If they result from conditions that did not exist at the balance sheet date, arose after that date, and do merit adjustment • Neither recorded or disclosed • Nonaccounting events or conditions that management normally communicates through other means

“RESERVES” • This term may be misinterpreted as a “fund of cash” • Confusing uses of “Reserves” • Contra asset: • Reserve for uncollectible accounts • Reserve for depreciation • Estimated liability (Reserve for warranties) • Appropriation of Retained Earnings (Reserve for future expansion) • Term, “reserve” should really be eliminated

RETAINED EARNINGSRestrictions (Appropriations) • Limit the ability of the corporation to declare dividends • Required by law or contract • Voluntary decision by the Board of Directors • Entry is reversed when the reason for the restriction ceases to exist • The term “reserve” is permitted - but should be avoided since it is misleading!!!

Limitations of Balance Sheet • Current value amounts may not be shown on the Balance Sheet. • Contains many estimates. • Certain assets and liabilities are not shown on the Balance Sheet, e.g., human resources.

Ratio Analysis • Liquidity (Solvency) Ratios • Current Ratio • Acid-test Ratio • Efficiency Ratios • Inventory Turnover • Equity Position and Coverage Ratios • Debt-to-Equity • Profitability Ratios • Earnings Per Share