BEPS 2.0 PILLAR ONE AND PILLAR TWO

0 likes | 1 Views

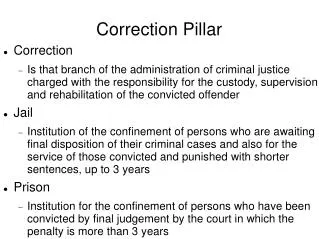

The BEPS 2.0 framework is reshaping global tax norms, compelling MNEs to realign transfer pricing strategies. Pillar One redefines profit allocation through Amount A and Amount B, while Pillar Two enforces a 15% global minimum tax via GloBE rules. Together, they curb base erosion and profit shifting, demanding stronger compliance, documentation, and governance. For businesses, the challenge lies in modeling exposures, adapting policies, and aligning with evolving OECD guidelines. SKMC Global supports enterprises in navigating Pillar One and Pillar Two by redesigning transfer pricing structure

Download Presentation

BEPS 2.0 PILLAR ONE AND PILLAR TWO

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

More Related