Introduction

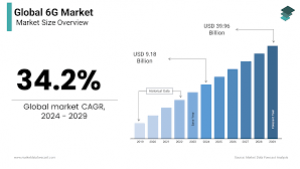

The Global 6G Market, valued at USD 4.6 billion in 2030, is projected to reach USD 69.3 billion by 2035, growing at a CAGR of 77.2%, driven by the demand for ultra-fast, low-latency connectivity and advanced IoT applications. 6G, leveraging AI, terahertz waves, and holographic communication, transforms smart cities, autonomous vehicles, and healthcare. North America leads with a 40% share, fueled by technological innovation, while Asia-Pacific grows rapidly due to 6G investments in China and South Korea. This market reflects the evolution toward next-generation, intelligent connectivity solutions across industries. Key Takeaways Market growth from USD 4.6 billion (2030) to USD 69.3 billion (2035), CAGR 77.2%. Wireless technology dominates with a 60% share; IoT leads applications. North America holds 40% share; Asia-Pacific grows fastest at 80% CAGR. Enterprises and consumers are key end-users. High R&D costs and regulatory hurdles pose challenges. Opportunities include AI-driven networks and smart city applications. End-User Analysis The 6G market serves enterprises, consumers, and government sectors. Enterprises lead with a 45% share in 2030, driven by IoT, smart manufacturing, and autonomous systems. Consumers benefit from AR/VR and holographic communication, growing at a 78% CAGR. Government applications, including smart cities and public safety, expand rapidly, leveraging 6G’s ultra-low latency and high bandwidth for real-time data processing and secure communication in critical infrastructure. Industry Analysis Key industries include telecommunications, automotive, healthcare, and smart cities. Telecommunications dominates with a 50% share in 2030, driven by 6G infrastructure development. Automotive leverages 6G for vehicle-to-everything (V2X) communication, enhancing autonomous driving. Healthcare, growing at a 79% CAGR, uses 6G for telemedicine and remote surgeries. Smart cities adopt 6G for real-time traffic and energy management, with Asia-Pacific’s industrial growth accelerating cross-industry adoption. Market Segmentation By Technology: Wireless (60% share), Wired. By Application: IoT, AR/VR, Holographic Communication, Autonomous Vehicles, Telemedicine. By End-User: Enterprises (45% share), Consumers, Government. By Industry: Telecommunications (50% share), Automotive, Healthcare, Smart Cities. By Region: North America (40% share), Asia-Pacific (80% CAGR), Europe, Latin America, Middle East & Africa. Restraint High R&D costs for 6G infrastructure, complex spectrum allocation, and regulatory challenges hinder growth. Developing terahertz wave technology and achieving global standardization demand significant investment. Cybersecurity risks in hyperconnected networks and data privacy concerns, such as GDPR compliance, limit adoption. Limited infrastructure and skilled expertise further restrict market expansion, especially for smaller players in emerging markets. SWOT Analysis Strengths: Ultra-fast connectivity, low latency, strong North American innovation. Weaknesses: High R&D costs, standardization complexities. Opportunities: Asia-Pacific expansion, AI-driven networks, smart city growth. Threats: Regulatory hurdles, cybersecurity risks, infrastructure limitations. The market’s potential relies on overcoming cost and regulatory barriers while leveraging AI and IoT advancements. Trends and Developments 6G advancements include AI-driven network optimization, with China’s 2030 6G satellite trials enhancing connectivity. Terahertz waves enable speeds 100x faster than 5G, supporting holographic communication. Smart city initiatives, like Japan’s USD 600 million 6G program, drive adoption. AR/VR applications grow in automotive and healthcare, while global R&D, including the EU’s USD 350 million 6G investment, accelerates development. Asia-Pacific’s 80% CAGR reflects China’s infrastructure push and India’s digital initiatives. Key Players Analysis Nokia, Ericsson, Huawei, Samsung, and Qualcomm lead the 6G market. Nokia and Ericsson advance 6G infrastructure with AI solutions, while Huawei’s terahertz research boosts connectivity. Samsung’s 6G trials focus on holographic communication, and Qualcomm’s chipsets enable low-latency applications. Partnerships, like Ericsson’s 2030 USD 450 million 6G collaboration, and investments by Verizon and AT&T drive innovation, intensifying competition. Conclusion The Global 6G Market is set for explosive growth, driven by ultra-fast connectivity and IoT demands. Despite R&D and regulatory challenges, opportunities in Asia-Pacific and AI-driven networks promise transformation. Key players’ innovations will redefine connectivity across industries by 2035.