Introduction

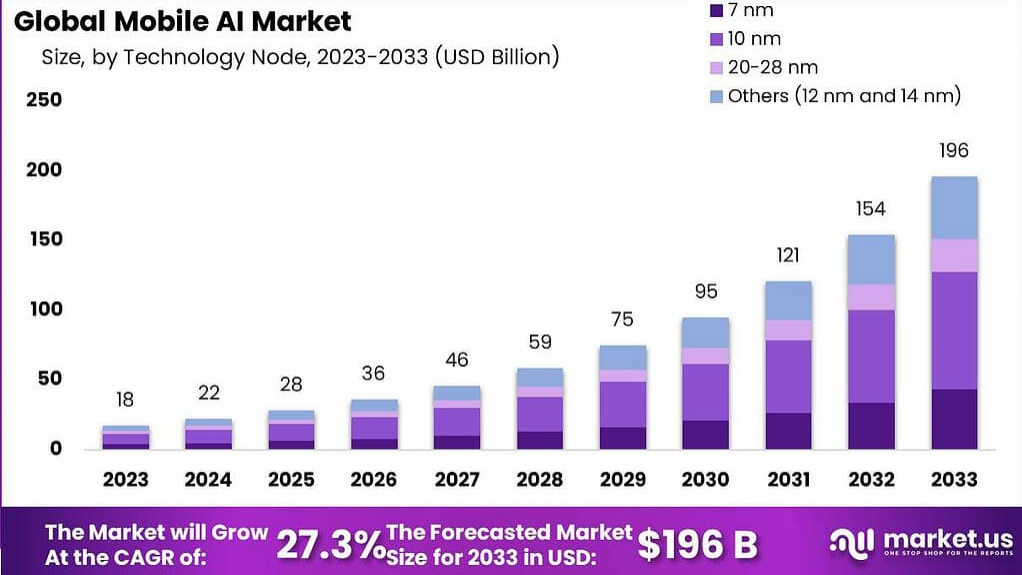

The Global Mobile AI Market is poised for exponential growth, projected to surge from USD 18 billion in 2023 to USD 196 billion by 2033, achieving a CAGR of 27.3%. Mobile AI, integrating machine learning and neural networks into smartphones and devices, enhances user experiences through personalization, voice assistants, and real-time analytics. Driven by rising smartphone penetration, advancements in AI chipsets, and demand for intelligent applications, the market is transforming industries like consumer electronics and healthcare. With robust investments and technological innovation, mobile AI is set to redefine device functionality globally. Key Takeaways Market Growth: From USD 18 billion in 2023 to USD 196 billion by 2033, at a 27.3% CAGR. Key Drivers: Smartphone adoption, AI chipset advancements, and demand for intelligent apps. Dominant Segments: On-device AI, consumer electronics, and voice assistants lead. Challenges: High development costs, privacy concerns, and power consumption issues. Regional Insights: North America leads; Asia-Pacific grows fastest due to tech adoption. Solution Type Insights The market segments into on-device AI and cloud-based AI solutions. In 2023, on-device AI held a 60% share, driven by its low latency, enhanced privacy, and offline capabilities, ideal for mobile applications. Cloud-based AI, growing at a 28.5% CAGR, offers scalability and complex processing for resource-intensive tasks. On-device AI dominates due to user demand for secure, real-time processing, while cloud-based solutions support advanced analytics, balancing performance and flexibility to meet diverse mobile AI needs across industries. CPG Subsector Insights Subsectors include consumer electronics, healthcare, automotive, and others. Consumer electronics led with a 55% share in 2023, fueled by AI integration in smartphones and wearables for features like facial recognition. Healthcare, with a 29% CAGR, leverages mobile AI for diagnostics and patient monitoring apps. Automotive uses AI for in-vehicle assistants. Consumer electronics dominate due to widespread device adoption, while healthcare drives growth through innovative, AI-powered mobile health solutions. Application Area Insights Applications include voice assistants, image recognition, chatbots, and predictive analytics. Voice assistants held a 40% share in 2023, driven by AI-powered features like Siri and Google Assistant. Image recognition, growing at a 30% CAGR, supports augmented reality and camera enhancements. Chatbots improve customer engagement, while predictive analytics optimize user experiences. Voice assistants lead due to their ubiquity, with image recognition fueling growth through advanced visual AI applications in mobile devices. By Application Analysis In 2023, voice assistants dominated with a 40% share, enhancing user interaction through natural language processing on mobile devices. Image recognition, with a 30% CAGR, drives innovation in AR, photography, and security applications. Chatbots enhance customer service, while predictive analytics personalizes user experiences. These applications boost mobile AI adoption, with voice assistants and image recognition leading due to their widespread integration, significantly improving device functionality and user engagement across sectors. Market Segmentation By Solution Type: On-Device AI, Cloud-Based AI By CPG Subsector: Consumer Electronics, Healthcare, Automotive, Others By Application Area: Voice Assistants, Image Recognition, Chatbots, Predictive Analytics By Region: North America, Asia-Pacific, Europe, Latin America, Middle East & Africa Restraints High development costs for AI chipsets and software limit adoption, especially for smaller firms. Privacy concerns, driven by data collection on mobile devices, pose challenges under regulations like GDPR. High power consumption of AI processing strains device batteries. Skill shortages hinder innovation. Addressing these requires cost-effective solutions, robust privacy frameworks, and energy-efficient technologies to ensure scalable mobile AI adoption. SWOT Analysis Strengths: Enhanced user experiences, real-time processing, and device personalization. Weaknesses: High costs, privacy risks, and power consumption issues. Opportunities: Smartphone growth, AI chipset innovation, and healthcare applications. Threats: Regulatory constraints and skill shortages. This analysis highlights mobile AI’s transformative potential while emphasizing the need to address cost and privacy barriers for sustained growth. Trends and Developments Trends include edge AI for on-device processing, 5G-enabled low-latency apps, and generative AI for content creation. Investments, like Qualcomm’s $200 million AI chipset fund in 2023, drive innovation. Partnerships, such as Google’s mobile AI collaborations, accelerate adoption. Focus on privacy-preserving AI and energy-efficient chips is rising. These trends position mobile AI as a cornerstone of intelligent devices, emphasizing performance, security, and user-centric solutions across industries. Key Player Analysis Key players include Qualcomm, Google, Apple, Samsung, NVIDIA, and MediaTek. Qualcomm and NVIDIA lead in AI chipsets, while Google and Apple excel in on-device AI integration. Samsung drives AI in consumer electronics, and MediaTek focuses on affordable chipsets. Strategic alliances, like Qualcomm’s 5G-AI partnerships, and acquisitions strengthen market positions. These players shape the mobile AI market through innovation and scalability. Conclusion The Global Mobile AI Market, growing from USD 18 billion in 2023 to USD 196 billion by 2033 at a 27.3% CAGR, is revolutionizing devices. Despite cost and privacy challenges, AI advancements fuel progress. Investments and privacy-focused innovations will ensure sustainable, transformative market growth.