Refund Process under GST across Different Categories

0 likes | 48 Views

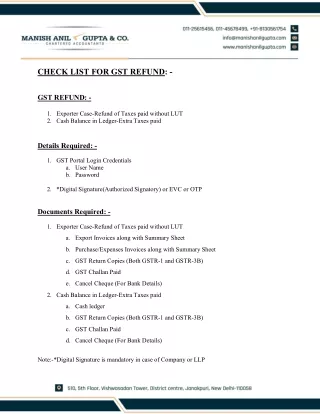

The procedure for seeking u2019Refund under GSTu2019 has been evolving ever since the GST law has been implemented. There have been quite a few circulars issued clarifying the procedure for seeking refund under different categories. Timely refund not only helps the businesses in smooth functioning, it also gives a boost to the working capital.<br><br>In this article, we have attempted to summarize the computation of refund amount under different categories along with broadly outlining the process.

Download Presentation

Refund Process under GST across Different Categories

An Image/Link below is provided (as is) to download presentation

Download Policy: Content on the Website is provided to you AS IS for your information and personal use and may not be sold / licensed / shared on other websites without getting consent from its author.

Content is provided to you AS IS for your information and personal use only.

Download presentation by click this link.

While downloading, if for some reason you are not able to download a presentation, the publisher may have deleted the file from their server.

During download, if you can't get a presentation, the file might be deleted by the publisher.

E N D

Presentation Transcript

More Related